Tata Motors Share Price – Amidst the din of the Indian stock market, there are few shares that attract as much notice as Tata Motors. It’s a brand that is heard in almost every Indian home, yet its life on the share market has been far from smooth, straight sailing. If you’ve been tracking the Tata Motors share price over the decades, you’ve seen a tale of high-profile turnaround, international aspirations, and a phoenix-like rise that has turned it into one of the favorite shares of investors.

From the humble Tata Sierra and Indica to the world prestige of Jaguar Land Rover (JLR) and today’s electric vehicle (EV) boom, the company has seen it all. But what is actually propelling its share price today? Is it a good long-term gamble, or is it running on short-term momentum? Let’s take a turn and peer underneath the bonnet of the drivers propelling this car giant’s stock.

What is Tata Motors? More Than a Car

Let’s get a glimpse of the creature before we dissect the price charts. Tata Motors is not merely an automobile company; it’s an enormous automobile conglomerate. Its operations are widely divided into three important segments:

- Jaguar Land Rover (JLR): This is the crown jewel. The acquisition of these symbolically important British luxury brands gave Tata Motors global player status. JLR generates the lion’s share of the firm’s revenue and profitability, so its performance is key to the health of Tata Motors as a whole.

- Domestic Passenger Vehicles: These are all types of cars and SUVs available in India, ranging from the smallest Tata Tiago to the best-selling Tata Nexon and Harrier. This segment has witnessed a stunning revival in recent times, thanks to strong new designs and a keen emphasis on safety.

- Commercial Vehicles: This is the old backbone of the company. Trucks, buses, and light commercial vehicles comprise the logistics and transport backbone of India. This is a very cyclical segment and relies significantly on the economic growth of the country and infrastructure activity.

Comprehension of this three-pillared model is the prelude to deciphering the Tata Motors share price.

Key Drivers Behind the Tata Motors Share Price Movement

The Tata Motors stock does not fluctuate on a single axis. It is a nuanced mix of worldwide luxury trends, local consumer morale, and macroeconomic factors. These are the main drivers and brakes:

1. The Jaguar Land Rover (JLR) Performance: This is undoubtedly the strongest driver. Investors are fixated on JLR’s quarterly sales levels, especially in the core markets of China, Europe, and North America. Direct drivers of the share price are:

* JLR Quarterly Sales Volumes: Positive numbers, especially on high-margin models such as the Range Rover and Defender, are huge positives.

- EBIT Margins: JLR’s profitability comes under the microscope. Margin improvement indicates cost-effective operations and pricing power.

- The Electric Transition: How JLR manages its electric vehicle strategy and success, such as with the Jaguar I-PACE and future models, is closely monitored as a harbinger of its future.

2. The Domestic Comeback Story: Success of Tata Motors’ passenger vehicle business in India has been one of the prime re-rating drivers. “New Forever” brand of cars and SUVs has clicked. Investors seek:

* Monthly Sales Figures: Steady increase in domestic passenger vehicle sales.

- Market Share Gains: Consistently gaining market share from rivals is an extremely bullish sign.

- Electric Vehicle Leadership: With the Nexon EV and others, Tata Motors is the clear leader in India’s EV market. Each new EV release or monthly EV sales data is a huge catalyst for the stock.

3. Commercial Vehicle (CV) Cycle: The CV sector is an economic indicator of the Indian economy. Industrial activity is high when goods transport is high, which boosts truck demand and the success of this segment. Govt. infra projects such as the National Infrastructure Pipeline positively impact the CV segment.

4. Commodity Prices and Supply Chains: This is an important cost driver. Steel, aluminum, and semiconductor prices directly affect Tata Motors’ cost of production and profitability. Relief from easing semiconductor shortages, for example, has been a big help, enabling improved production planning.

5. Financial Health and Debt: The market closely monitors the net automotive debt of the company. A steady decline in debt, fueled by solid cash flow from JLR and the local business, enhances investors’ confidence and renders the stock more desirable.

6. Global Macroeconomic Factors: As JLR is a global luxury brand, the share price of Tata Motors is subject to occurrences such as recessions in the US or Europe, fluctuations in currency exchange rates (particularly the GBP/INR), and trade policy.

The Recent Rally: What’s Fueling the Optimism?

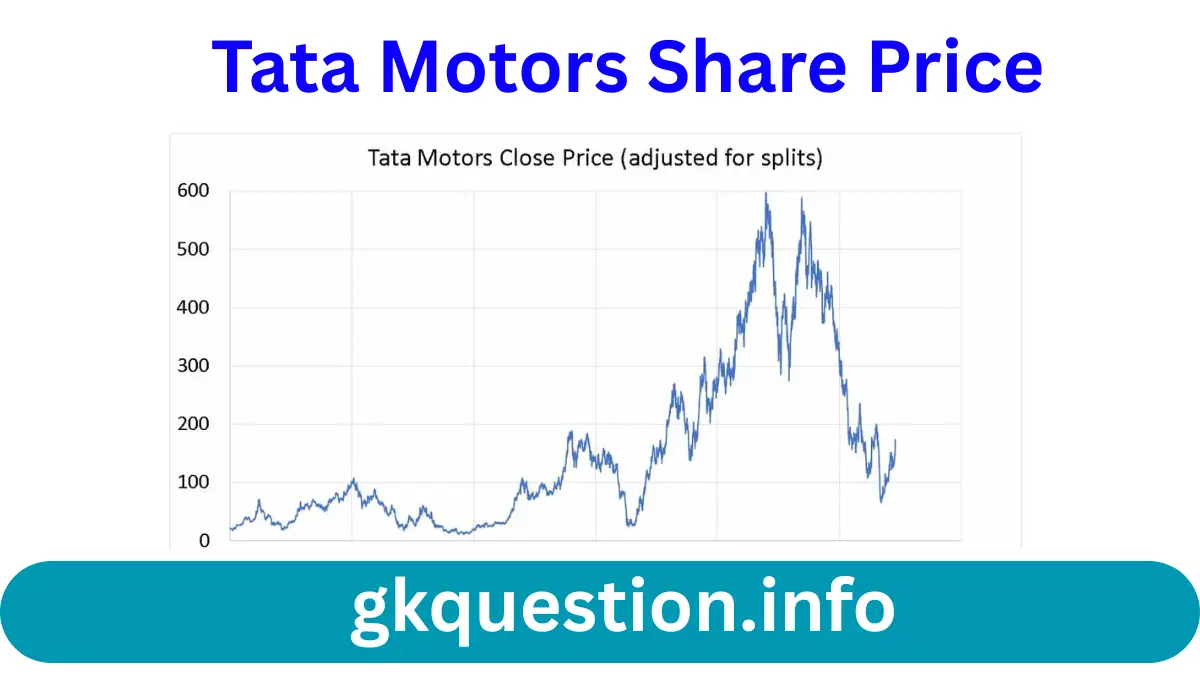

If you examine the Tata Motors stock price graph during the past two years, you’ll notice a strong upward trajectory. It’s not coincidental. It’s been driven by a “perfect storm” of encouraging trends:

- Revival of JLR: Following a tough phase, JLR has shown spectacular results with high demand for its premium models and substantially better profitability.

- EV Dominance in India: The first-mover advantage of Tata in the electric passenger vehicle market has generated huge enthusiasm and makes it the biggest beneficiary of India’s transition towards a greener economy.

- Total Debt Reduction: The diligent efforts of the company to become net automotive debt-free have been viewed extremely positively by the market.

The Road Ahead: Long-Term Outlook

Attempting to guess next month’s price is a waste of time. The issue is with the direction over the long term.

The story for Tata Motors continues to be strong. It is in an exclusive space with a portfolio of global luxury brands and leadership, future-proofed, in the huge Indian market. The long-term directions of premiumization in the auto business and worldwide electrification are the former’s strengths.

But investors need to be ready for the rough patches. The automobile sector is cyclical, and it is highly competitive. Slowing down in major global economies or a misstep in the electric vehicle race could bring about volatility.

Conclusion

The tale of the Tata Motors share price is one of fascinating heritage, global aspiration, and future-proof strategy. It is no longer merely an Indian automaker stock; it’s a sophisticated and intriguing gamble on luxury, utility, and electric mobility.

For an investor, the strategy must be considered. It’s important to consider more than just one quarter and evaluate the company’s performance on all three of its pillars. Watch JLR’s margins, follow domestic EV sales, and observe levels of debt.

Tata Motors can be a cornerstone of a long-term growth portfolio, but one needs the patience to ride it out through the inevitable cycles of the industry. The engine is chugging along well; the trick is to make sure that your journey as an investor is along its long-term path.

Disclaimer: This article is for informational and educational purposes only. It is not a recommendation to buy or sell any securities. The examples given are for illustrative purposes. Please consult with a qualified financial advisor before making any investment decisions.